November 5 Election '24

Proposition 1: PASSED, 56.78% for the proposal, 43.22% against

Proposition 2: PASSED, 55.21% for the proposal, 44.79% against

PROPOSITION "Shall Ordinance No. 1055(24) of the City of Moore, Oklahoma be approved which renews the levy and collection of an existing excise (sales) tax of one-fourth of one percent (0.25%) in addition to all other excise or sales taxes levied by the City or any other taxing authority, upon the gross proceeds or gross receipts derived from all sales to any person taxable under the Oklahoma Sales Tax Code; providing that the extension of the existing one-fourth of one percent (0.25%) excise or sales tax shall be limited to a period of four (4) years, commencing April 1, 2025, and ending March 31, 2029; and which Ordinance further states that all revenues and proceeds from said tax shall be used for existing parks and recreation facilities and The Moore Public Works Authority as specified in the Ordinance?"

It’s important to note that the City’s sales tax of 8.5% would remain the same should this proposition pass.

PROPOSITION "Shall the City of Moore, Oklahoma, incur an indebtedness by issuing its bonds in the amount of Six Million Seven Hundred Thousand Dollars ($6,700,000) to provide funds for the purpose of constructing, reconstructing, improving or repairing streets or bridges in said City, to be owned exclusively by said City, and levy and collect an annual tax, in addition to all other taxes, upon all the taxable property in said City sufficient to pay the interest on said bonds as it falls due, and also to constitute a sinking fund for the payment of the principal thereof when due, said bonds to bear interest at not to exceed the rate of 7 per centum per annum, payable semiannually and to become due serially within 20 years from their date?"

Section 2. The specific projects for which at least seventy percent (70%) of the proceeds of the aforesaid street or bridge bonds shall be expended, and the dollar amounts for each such project shall be as follows:

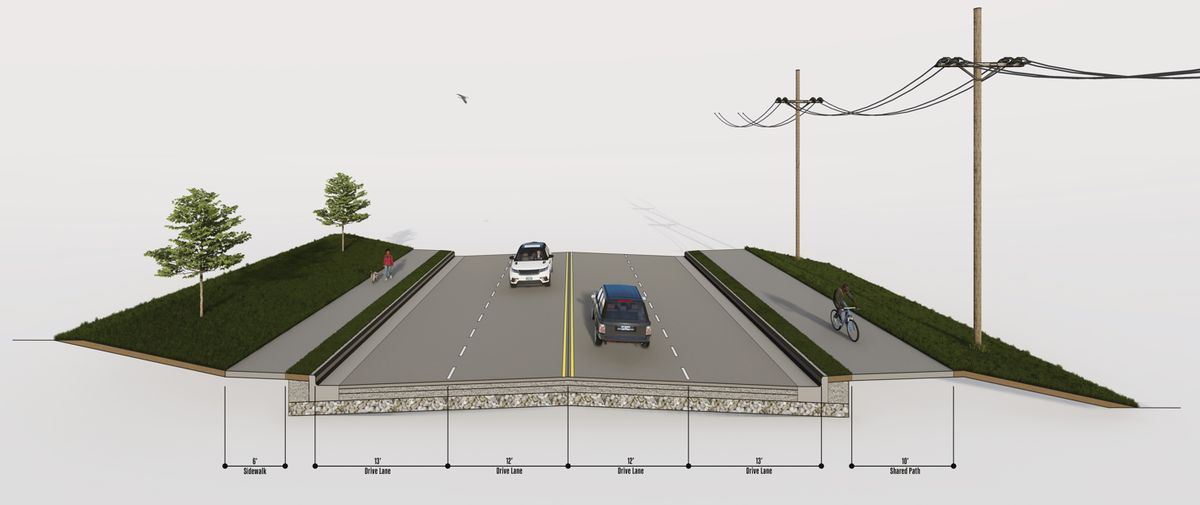

Project 1. Engineering and design expenditures and Resurfacing of Telephone Road from SW 34th Street south to the City Limits, which adjoins the City of Norman, Oklahoma.

It’s important to note that the City’s millage rate would remain at or below 16.5 should this proposition pass.

Q and A for Proposition 1

Q: How will the revenue be allocated?

A: Seventy-Five percent (75%) of the proceeds of the sales tax shall be designated for the acquisition, construction, equipping and/or remodeling of existing Parks and Recreation facilities; and Twenty-Five percent (25%) of the proceeds of the sales tax shall be designated for The Moore Public Works Authority.

Q: Will this raise the City sales tax?

A: No. The City's portion of the sales tax will remain at 3.875%. The sales tax in Moore, charged on purchases, is currently 8.5%. Of this amount the City receives 3.875%, the State 4.5% and Cleveland County 0.125%.

Q: What are the dates this extension will run?

A: The timeline for the extension begins April 1, 2025 and expire March 31, 2029.

Q: What has been accomplished with the current ¼ cent sales tax that was approved in November of 2020?

A: The Station Expansion is complete and is used for programming, exercise classes and other events. The Public Works Facility improvements consisted of a new 21, 600 sq ft facility to house fleet and building maintenance.

Q and A for Proposition 2

Q: If approved, will this raise my property taxes?

A: The City is committed to keeping the millage rate at or below 16.5 mills for the City’s portion of property taxes. Bonds are issued in increments to ensure the millage rate is at 16.5 mills or less. An increase or decrease would be determined based on past/future millage rates that fluctuate based on total assessed valuations each year. Again, the City of Moore’s portion of property taxes will remain at or below 16.5 mills.

Q: What does "resurfacing" mean regarding this project?

A: Removal and replacement of sub-grade and base materials, as well as replacement of the existing driving surface with concrete.

Q: Is road widening included in this project?

A: Yes. The road that is currently 2-lanes will be widened to 4-lanes. Also included will be a trail and sidewalk.